Content

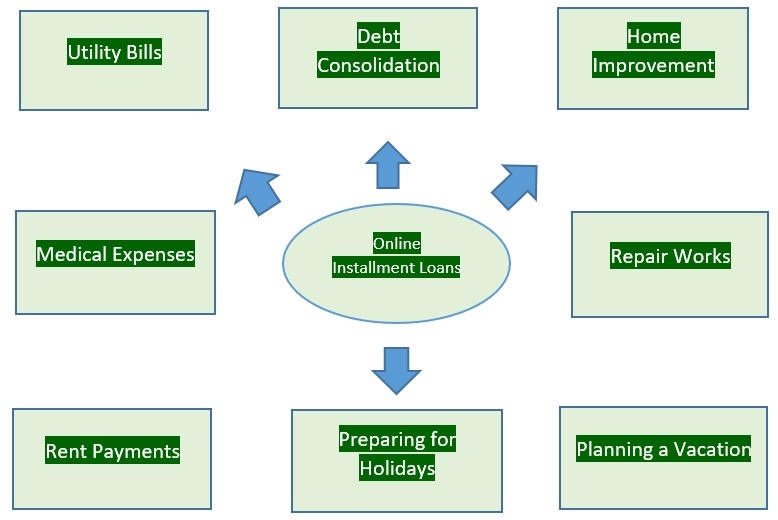

Someone make use of these financing for everyone categories of reasons — from consolidating debt and you may level disaster expenditures so you can dealing with major lifestyle occurrences including swinging otherwise surgical procedure. They’lso are a greatest choices as they give fixed monthly payments more a set identity, and then make budgeting more in check than simply large-attention revolving borrowing. Such example selections reveal just how much more costly fair-borrowing from the bank borrowing from the bank will likely be compared to prime consumers. Whether or not your own provide try no place close pay-day-financing region, higher twice-digit private-loan costs nevertheless seem sensible rapidly. The fresh safer financing demand setting connected during the this page links your to help you a network from lenders which can think about your federal a job history, not simply your credit rating.

Were there no credit check personal loans with protected approval?

After you apply, the job was delivered to LendYou’s member lenders. Is to a loan provider believe your fits their requirements for a loan, you could potentially discovered that loan offer. Instead of loan applications so you can traditional financial institutions, your web demand was processed rapidly because of CashUSA. Given specific financial institutions usually takes weeks to help you process a loan, it’s fairly unbelievable.

You ought to review your own bank’s terms and you may revival policy before you sign the borrowed funds contract. Later costs away from finance can lead to additional charges otherwise collection issues, otherwise both. Alternatives range between borrowing partnership money, signature loans from the lender, borrowing from the bank away from deals, otherwise talking to an official credit specialist. For the majority of government staff, an enthusiastic allowance design loan is just one option certainly one of numerous, perhaps not the only way. You could start the loan request because of a straightforward, secure on the web mode one connects you having a network of lenders one think federal work since the a button factor. Government personnel across the Us know very well what they feels like to view the brand new calendar plus the bills meanwhile.

A Common Borrowing from the bank personal loan may be a no brainer for individuals with down fico scores who would like to consolidate debt. Lacey Stark are a self-employed individual finance blogger for Finder, specializingin financial, finance, spending, property planning, and a lot more. This lady has 20years of expertise composing and you may editing to own journals, click, andonline publications.

Q: How quickly is also government team receives a commission away from an allocation build financing?

Following, have fun with a cost online calculator to see which Apr and payment identity you’d need affordable monthly obligations. A longer fees term can cause lower monthly payments, however’ll find yourself using far more inside the total focus. People having down fico scores should expect to expend higher desire costs. Best Eggs also provides two implies for you to secure a personal cost mortgage. You can either explore a vehicle because the collateral or permanent fittings of your house, including dependent-in the shelves. One of the benefits of going a guaranteed loan out of Best Egg is the fact that the costs try below their unsecured personal money.

For those who use to the Weekend, you can aquire the new funding to your second working day. Once you’ve accomplished the borrowed funds consult, the lender have a tendency to make certain it and make contact with you by cellular telephone or e-post. Can i get a fees Financing within the Sturgis, MI with less than perfect credit? Using this type of calculator isn’t a promise you are qualified to receive a loan. Am i able to get a Jersey Area, New jersey Payment Mortgage which have less than perfect credit? Cost Loan inside Jersey Town, Nj-new jersey is a good chance to lower your economic problems.

The guy made use of a browse Borrowing from the bank loan so you can roll numerous high-focus playing cards for the a single commission. By creating steady payments for three-years, his credit score mounted out of 595 to help you 670, and then he sooner or later qualified for a vintage financial loan to help california payday loans you refinance in the a reduced rate. It’s a personalized, safe, and clear method of borrowing, created for those navigating economic filter systems, erratic borrowing records, or sudden expenditures. With over 565,000 People in america assisted as the 2019 and most $289 million saved in the charge, the company understands what works and you may exactly what will not to own today’s high-chance borrowers. All the lender features its own fine print and you will restoration coverage, which may change from lender so you can financial.

Finest Unsecured loans for Less than perfect credit Secured Recognition Direct Loan providers right up to help you $5000 Zero Credit check – Payday Opportunities

Specific individuals don’t like getting the cash in one to lump sum while they can not re-availableness the brand new limit. Once they you desire more income, they have to look at the borrowing techniques once again and you can either enhance their amount borrowed or rating other loan. The brand new fixed money is going to be difficult for people to cope with also. For individuals who skip repayments otherwise create limited costs, you might wreck your credit score also.

- Zero legitimate bank often promise protected recognition, particularly instead checking your financial history.

- A less than perfect credit rating try any credit rating less than 579, from which 16% of all the people has a get inside variety.

- Individual fees fund can be used for a variety of objectives in addition to debt consolidating, do-it-yourself projects, vehicle repairs, surgical procedure, high purchases, wedding parties and you may travelling.

- This isn’t the rules to market otherwise render availability to such advice to unaffiliated businesses.

Having fun with AI-driven loan-complimentary technology, it democratizes emergency money to possess underbanked and you will underserved People in america. Chief executive officer Alex Zadorian says RadCred links the credit pit thanks to transparent, moral credit when you are producing economic addition through degree, in charge borrowing from the bank information, and nonprofit partnerships. RadCred’s no credit score assessment fund eventually differ from conventional payday loan inside the construction and you may transparency. Individuals access disaster financing possibilities rather than security requirements or detailed files, addressing immediate cash needs when family members you need relief extremely. The brand new platform’s transparent rates and no-hidden-fee structure make sure individuals know will set you back initial. Prior to investing in a premier-attention fees mortgage, evaluate these almost every other money options.

Ultimately, for every borrower should determine whether delivering a payment mortgage may be worth they. Looking for a guaranteed payment financing for poor credit is generally difficult. When you’re new to your credit score, you should begin by examining your credit score. Once you learn what your credit rating is that you could find a loan provider which will help.

Since the term suggests, BadCreditLoans helps link people with poor credit to loan providers inside their time of you would like. The newest economic opportunities had become 1998, becoming an advocate to possess users and you will complimentary these with a good network away from loan providers willing to top within the bucks to those having poor credit. High-desire installment loan providers can charge triple-digit APRs in order to users having less than perfect credit.

On the web Fees Fund and no Difficult Credit check

Inside the February, four government regulatory companies create a mutual report taking the fresh dreadful dependence on such lenders from the wake out of COVID-19. Payment financing to have poor credit because of lead lenders will be a lifeline for the majority of at this time. They offer independency and you will reasonable cost, and once they meet with the advice establish because of the financial bodies, they could be the most suitable choice.

Considering CashAmericaToday, you should buy approved to possess an installment financing in minutes – no hard credit assessment to check qualifications; additional verification may be needed. The process is quick, safer, and you may available for actual-lifetime emergencies. We are an immediate loan providers for bad credit providing installment finance that have no difficult credit assessment. Approval is dependant on your income and you can fees function, not just your credit history. Pertain in minutes and you may, immediately after acknowledged, receive fund if the same working day.